The Group delivered a stable performance in the second quarter of the year, which was characterised by a challenging global environment and soft demand. Acquisitions contributed positively to the outcome, with the Group’s revenue up 7 per cent and EBITA improving 5 per cent during the quarter compared with the year-earlier period. Year to date, six companies have been acquired, of which two in Q2, with a combined annual revenue of approximately SEK 300 million.

Second quarter 2025

- Revenue increased by 7% to SEK 824 million (773), of which –2% for comparable units.

- Operating profit increased by 1% to SEK 78 million (77), corresponding to an operating margin of 9.5% (10.0).

- EBITA increased by 5% to SEK 92 million (88), corresponding to an EBITA margin of 11.2% (11.4).

- Profit for the quarter amounted to SEK 54 million (54), corresponding to earnings per share of SEK 1.05 (1.05).

- Acquisition of Norwegian Håland Instrumentering, a leading supplier of solutions within valves, field instrumentation, and fire and gas detection.

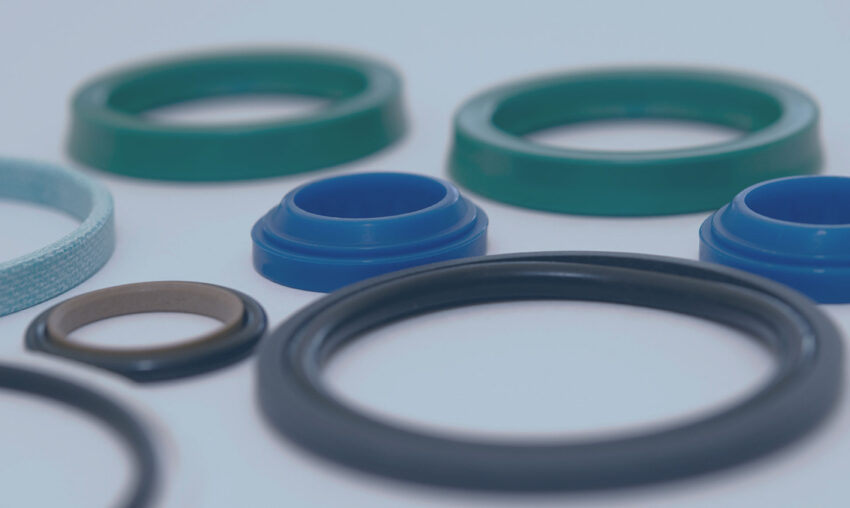

- Acquisition of TTP Seals, a leading specialist company in sealing technology in Norway.

January–June 2025

- Revenue increased by 9% to SEK 1,559 million (1,434), of which –1% for comparable units.

- Operating profit was charged with costs affecting comparability of SEK –3 million (-) and amounted to SEK 139 million (142), corresponding to an operating margin of 8.9% (9.9).

- EBITA increased by 3% to SEK 168 million (163), corresponding to an EBITA margin of 10.8% (11.4).

- Profit for the period amounted to SEK 98 million (97), corresponding to earnings per share of SEK 1.90 (1.90).

- The return on working capital (EBITA/WC) was 58% (59).

- The equity/assets ratio was 29% (30) at the end of the period.

- As of 30 June 2025, the number of repurchased shares of series B amounted to 1,044,259.

- During the first quarter, Heinolan Hydrauliikkapalvelu, Hörlings Ventilteknik, Sulmu and Avoma were acquired.

Events after the end of the period

- No significant events have occurred after the end of the period.

A quarterly presentation is available on the company’s website, momentum.group, where Ulf Lilius, CEO and Niklas Enmark, CFO present the report and provide an update on operations.