The Group’s operations continued to deliver favourable sales growth during the quarter, with organic revenue growth of 1%. The Group’s revenue increased by a total of 41% year on year, where acquired businesses contributed in particular to this growth. EBITA increased by 35 per cent compared with the same quarter last year. Year to date, seven companies have been acquired, adding combined annual revenue of approximately SEK 250 million.

Second quarter 2024

- Revenue increased by 41% to SEK 773 million (549), of which 1% was attributable to comparable units.

- Operating profit rose by 31% to SEK 77 million (59), corresponding to an operating margin of 10.0% (10.7).

- EBITA increased by 35% to SEK 88 million (65), corresponding to an EBITA margin of 11.4% (11.8).

- Profit for the quarter amounted to SEK 54 million (43), corresponding to earnings per share of SEK 1.05 (0.90).

- Acquisition of KmK Instrument, a specialist in measurement technology, non-destructive testing and material testing.

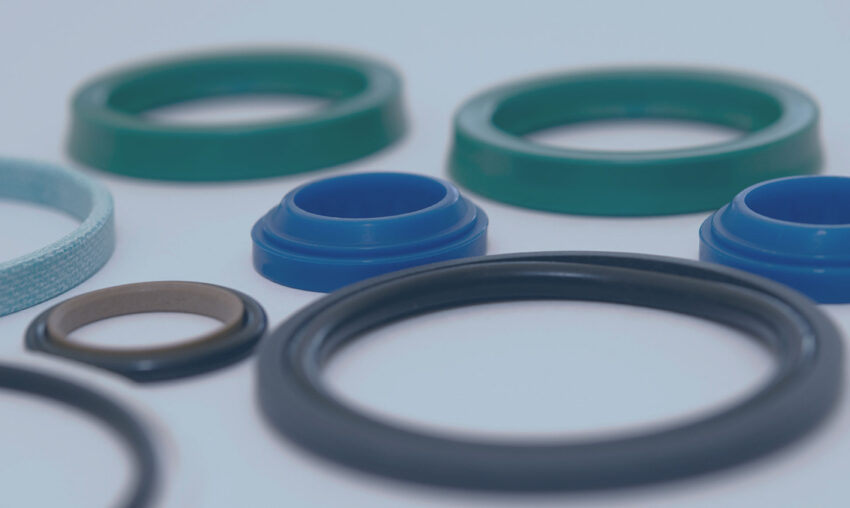

- Acquisition of Hydjan, a specialist in hydraulics and pneumatics in Finland.

- Acquisition of WH-Service, a full-service supplier of rotating equipment.

- Acquisition of Sikama, a specialist in gas and fluid handling.

- Acquisition of ZRS Testing Systems, a specialist in material testing and calibration.

- Acquisition of Minrox, a specialist in flow technology for exposed environments and extremely abrasive processes.

January–June 2024

- Revenue increased by 36% to SEK 1,434 million (1,051), of which 3% was attributable to comparable units.

- Operating profit rose by 25% to SEK 142 million (114), corresponding to an operating margin of 9.9% (10.8).

- EBITA increased by 30% to SEK 163 million (125), corresponding to an EBITA margin of 11.4% (11.9).

- Profit for the period amounted to SEK 97 million (85), corresponding to earnings per share of SEK 1.90 (1.75).

- The return on working capital (EBITA/WC) was 59% (60).

- The equity/assets ratio was 30% (32) at the end of the period.

- As of 30 June 2024, the number of repurchased Class B shares totalled 1,053,766.

- As of 1 January 2024, the business was divided into two business areas: Industry and Infrastructure.

- During the first quarter, PW Kullagerteknik was acquired.

Events after the end of the period

- No significant events have occurred after the end of the period.

A quarterly presentation is available on the company’s website, momentum.group, where Ulf Lilius, CEO and Niklas Enmark, CFO present the report and provide an update on operations.